5 Easy Facts About Business Owners Policy: BOP Insurance Quotes & Guide Described

Business Owners Policy - BOP Insurance - EMC Insurance

Business Owner's Policy (BOP) - Get a Free Quote - NEXT Can Be Fun For Anyone

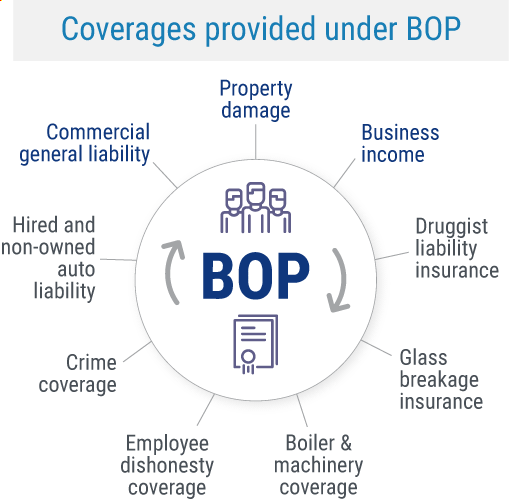

Entrepreneur insurance, also understood as BOP insurance coverage, is a policy that integrates both home and liability protection into one bundle. It's popular among a variety of little and medium-sized companies such as dining establishments, wholesalers, retail shops and professionals. Discover more about BOP protection, cost and how you can secure your service through the Progressive Advantage Service Program.

This includes security versus liabilities like customer injury and home damage, advertising injury, and item associated claims. A BOP doesn't cover your employees. You'll need a separate employees' payment policy. Home Provides coverage for commercial buildings and the movable residential or commercial property owned by and used for business - referred to as business personal effects.

A BOP policy, like a lot of other policies, has particular protection exclusions that you must know. If you need defense for something that isn't covered, policy endorsements might be offered to extend protection. For instance, damage from earthquakes is typically left out from a BOP. If you reside in an area that's susceptible to earthquakes, you might desire to think about adding an endorsement to your policy to extend protection.

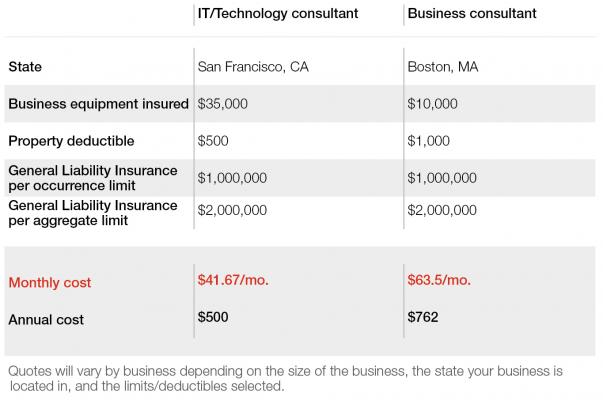

BOP cost In 2021, the median monthly expense of a BOP policy was $68 for brand-new Progressive consumers. The typical rate was $101 each month. Full Article suggests that a couple of pricey outliers made the average cost appear higher than what most policyholders invested. Your final rate will depend greatly on certain attributes of your service, including protection requirements, kind of profession, number of employees and claims history.

1 Business Owners Policy vsCommercial Package Policy - Embroker

Indicators on Business Owner's Policy (BOP) - Get a Free Quote - NEXT You Need To Know

Getting a customized quote is a fantastic way to find a rate that best matches your distinct situation. Call us straight or begin a quote online. Start securing your organization today Our team of internal professionals are professionals at helping small company owners, like you, find BOP insurance protection. They'll help you get a quote with the very best coverage for your particular service and budget.

Business Owner's Policy (BOP) - BOP Insurance for Business Owners

The liability protection readily available in a BOP is the same as a basic basic liability policy, consisting of home damage, item related claims and customer injury. What sets a BOP apart is that it consists of property coverage for commercial structures and other personal home owned and used by the company. It can protect you from things like fire damage, hail damage, theft and vandalism.